WorldRemit vs Monzo: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-23 14:13:02.0 11

International money transfers are evolving rapidly as users demand faster, cheaper, and more transparent options. Both WorldRemit and Monzo have become household names in the digital finance space, known for their easy-to-use apps and global coverage. However, each platform caters to different audiences with unique features and costs. For those seeking a third option, Panda Remit also stands out as a trusted alternative offering low fees and competitive exchange rates.

(External link: Investopedia Guide on International Money Transfers)

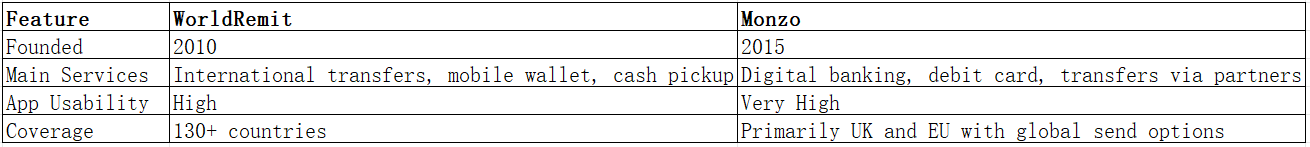

WorldRemit vs Monzo – Overview

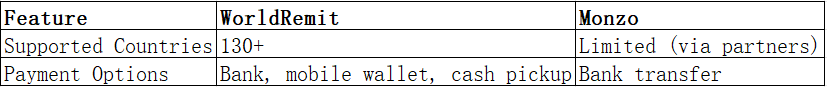

WorldRemit was founded in 2010 in London and quickly became a pioneer in online remittances. It allows users to send money to over 130 countries via bank deposit, cash pickup, and mobile money.

Monzo, established in 2015, started as a UK-based neobank offering personal and business banking services. It now includes international money transfer options through partnerships with established remittance providers.

While both services offer user-friendly apps and solid security, WorldRemit focuses more on direct remittance services, whereas Monzo emphasizes digital banking convenience. For users prioritizing dedicated money transfers, Panda Remit provides a specialized platform with strong exchange rates and low costs.

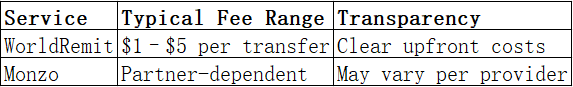

WorldRemit vs Monzo: Fees and Costs

WorldRemit typically charges a small transfer fee depending on the destination and payment method. These fees are clearly displayed before confirming a transaction. Monzo, by contrast, does not handle international transfers directly but through partners like Wise, meaning fees can vary.

Both companies offer transparent pricing, though WorldRemit often comes out cheaper for smaller transfers. Users seeking even lower-cost options may find Panda Remit competitive, offering minimal service charges.

(External link: NerdWallet Money Transfer Fees Guide)

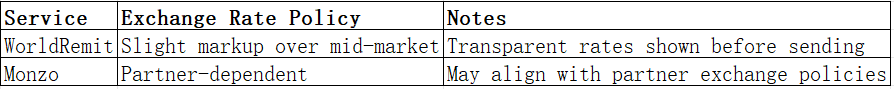

WorldRemit vs Monzo: Exchange Rates

Exchange rate markups can make a big difference in total cost. WorldRemit applies a small margin above the mid-market rate, while Monzo’s partner-based structure means rates can fluctuate depending on the provider.

Users often prefer services like Panda Remit, which emphasize transparent, near-market exchange rates with no hidden markups.

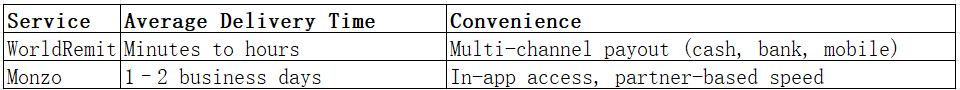

WorldRemit vs Monzo: Speed and Convenience

Speed matters in global remittances. WorldRemit processes most transactions within minutes to a few hours, depending on the payment method. Monzo’s transfer speed relies on third-party processors, which can result in slight delays.

For those seeking near-instant transfers, Panda Remit offers fast, fully digital delivery options with 24/7 service availability.

(External link: Remittance Speed Insights – Wise Blog)

WorldRemit vs Monzo: Safety and Security

Both providers are licensed and regulated in their operating regions. WorldRemit is authorized by the UK’s Financial Conduct Authority (FCA), while Monzo holds a UK banking license, ensuring deposits and transfers are well-protected.

They employ high-level encryption and two-factor authentication for secure transactions. Likewise, Panda Remit maintains rigorous compliance and encryption standards, offering users peace of mind when sending funds internationally.

WorldRemit vs Monzo: Global Coverage

WorldRemit supports over 130 destination countries with multiple payout options, including bank transfers, mobile wallets, and cash pickups. Monzo’s global transfer reach is expanding but remains focused mainly on UK and EU users sending abroad.

Users seeking broader coverage across Asia-Pacific or Latin America might consider Panda Remit, which supports over 40 currencies through various payout channels.

(External link: World Bank Remittance Data)

WorldRemit vs Monzo: Which One is Better?

The best choice depends on your specific needs:

-

Choose WorldRemit for fast, reliable, and specialized remittance services.

-

Choose Monzo if you already use its digital banking features and want occasional international transfers.

However, if you prioritize a balance of cost, transparency, and ease of use, Panda Remit can be a smart alternative. It combines competitive exchange rates with quick processing and flexible payment methods.

Conclusion

Both WorldRemit and Monzo bring valuable tools to the international money transfer market. WorldRemit excels in accessibility and global reach, while Monzo integrates transfers seamlessly within a broader banking ecosystem.

For users seeking a dedicated, affordable, and efficient remittance experience, Panda Remit stands out as an attractive choice. With high exchange rates, low fees, flexible payment methods (like POLi, PayID, and bank card), and 40+ supported currencies, it’s becoming a go-to platform for many international senders.